Join Now

Unlock unlimited access to all our content and get great discounts by purchasing a membership now

Learn more ….

James Coyle

James has over 35 years experience in financial services with particular expertise in two of the key components of retirement finance - Superannuation and the Age Pension. He is passionate about providing the guidance and support that can help older Australians enjoy their best possible retirement. He lives in regional Victoria surrounded by dogs and chooks.

If on a single pension, how much can the partner earn who hasn’t yet reached pension age

Hi Reg

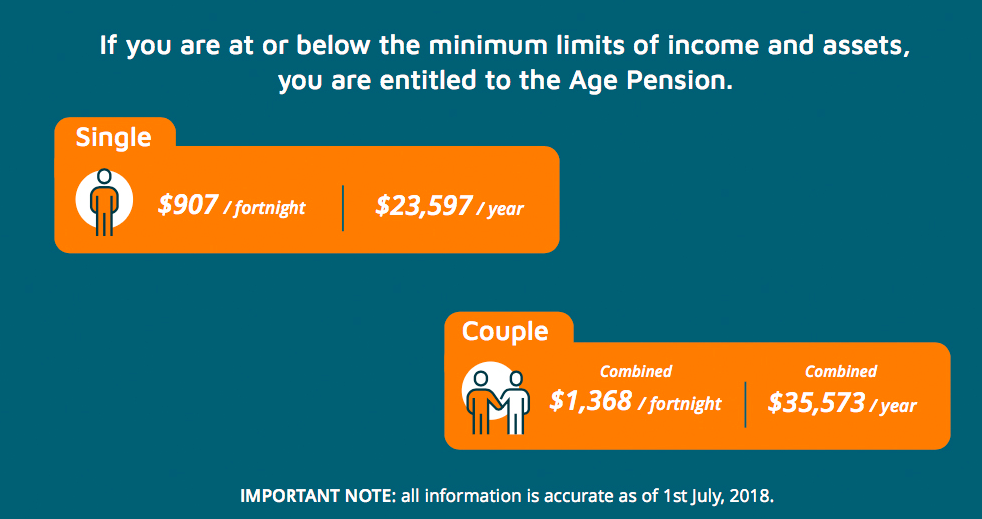

The maximum income a couple can earn before you lose a full pension payment is $7,904 gross per annum. The maximum income you can earn before you lose a part pension is $79,736 gross per annum. These income threshold includes both income generated from employment and deemed income from your assets.

It doesn’t matter if your partner hasn’t reached Age Pension age, the same threshold applies to your joint income.

Canyou tell me if the amount of money earned in a fortnight is it the net or gross income?

Hi Ann

When advising Centrelink of your income it needs to be the gross amount.