<main class="w-full max-w-4xl mx-auto my-8 md:my-12"> <div id="calculator-screen" class="calculator-card-container"> <h1 class="text-3xl md:text-4xl font-bold text-teal-800 mb-6 text-center">Age Pension Service Cost Calculator</h1> <p...

Uncategorized Articles

Who says retirees are risk averse?

Surprise survey results Retirement Pulse question: If you had $100,000 to invest which of the following would best describe your approach to the money? I would invest aggressively to achieve a high return, even if it involved a high level of risk. 5% I...

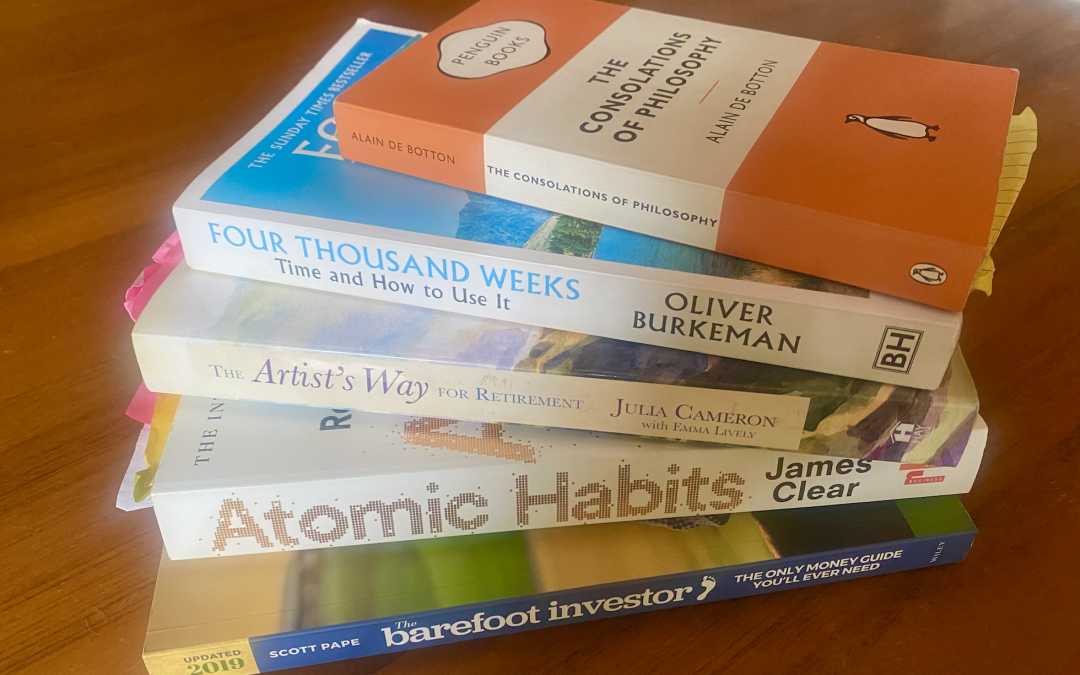

Easy summer reading for retirees

Easy summer reading list: Time to relax, read and reflect! We don’t know about you, but one of our favourite things at this time of the year is the prospect of days in the sun, reading and reading and reading. We checked with the team and many have long...

Are you Centrelink savvy?

Five things you may not know Last week we introduced you to the concept of the five pillars in retirement; the major sources of support that ensure income and financial wellbeing post-work. These are: The Age Pension superannuation the primary residence...

Timing your retirement and your entitlements

This is another instance where the onus is on you to get your application right. In Jargonbusters we explain the detail of age-related Age Pension eligibility. In the ‘old days’ it was easy – it was simply 65. Now it depends upon your year of birth. But...

Rocketing house prices – What do they mean for older Australians?

How long will the family home remain exempt? It’s hard to avoid the extensive media coverage of property price increases. There’s a reason for this and that’s because the 6.7% increase in the June quarter this year was the largest since the Australian Bureau...

Mistake four – Not controlling your spending

Australian household debt is the highest in the world. And at an all-time high at the time of writing. The ratio of household spending to income is now above 200%. Yes that means on average people are spending double what they are earning. . How did we get...

Deeming Rates

Centrelink uses deeming rates to determine how much you earn. These earnings are added to any other income streams and this total is used to assess your age pension eligibility and the rate you will be paid. The reason a ‘deeming rate’ is used is because...

The Cashless Welfare Card

A new bill has been introduced to the House of Representatives to curtail the use of Cashless Debit Cards (CDCs) for older Australians. The intention of giving welfare recipients this card was to prevent them from spending on substances which are harmful,...