by James Coyle | Dec 9, 2022 | Planning for Retirement, Retirement Income

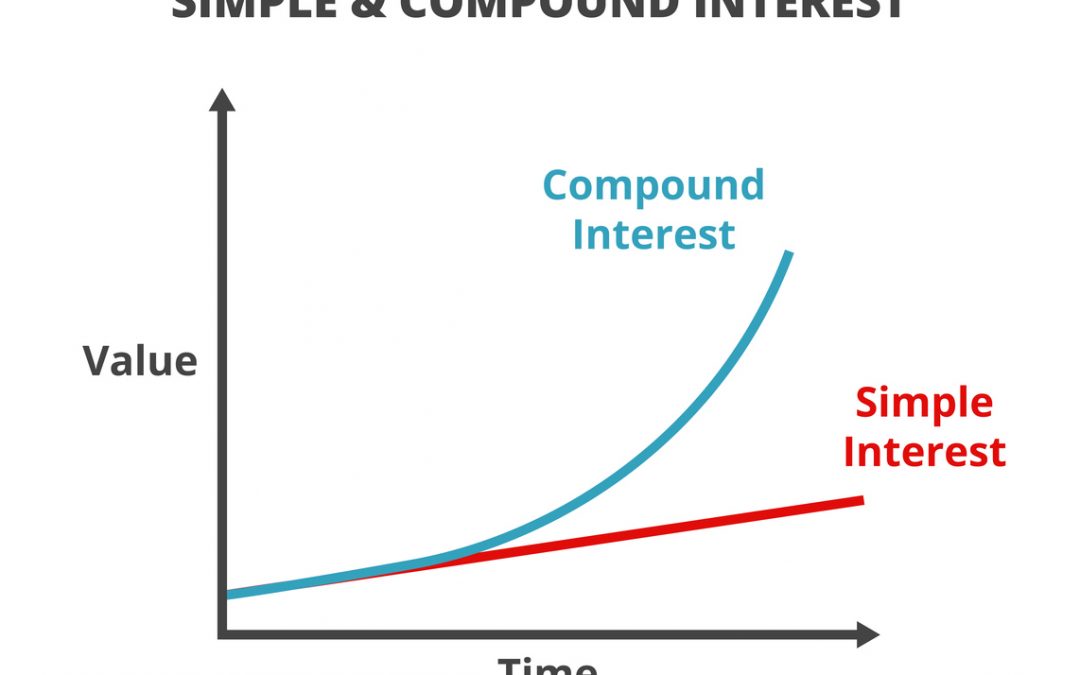

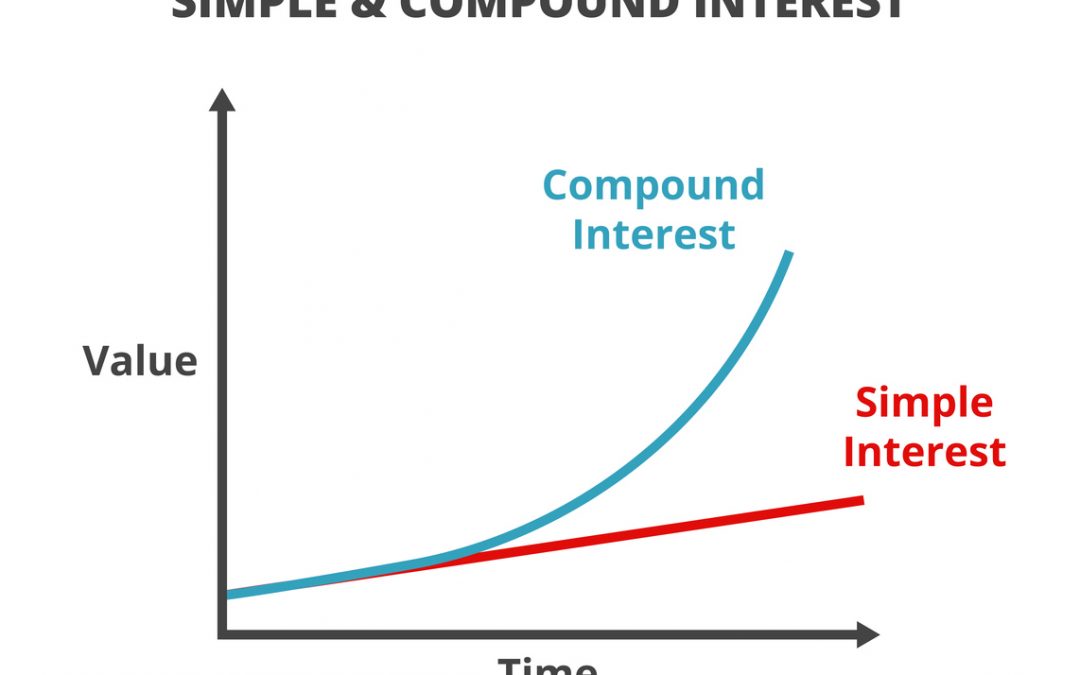

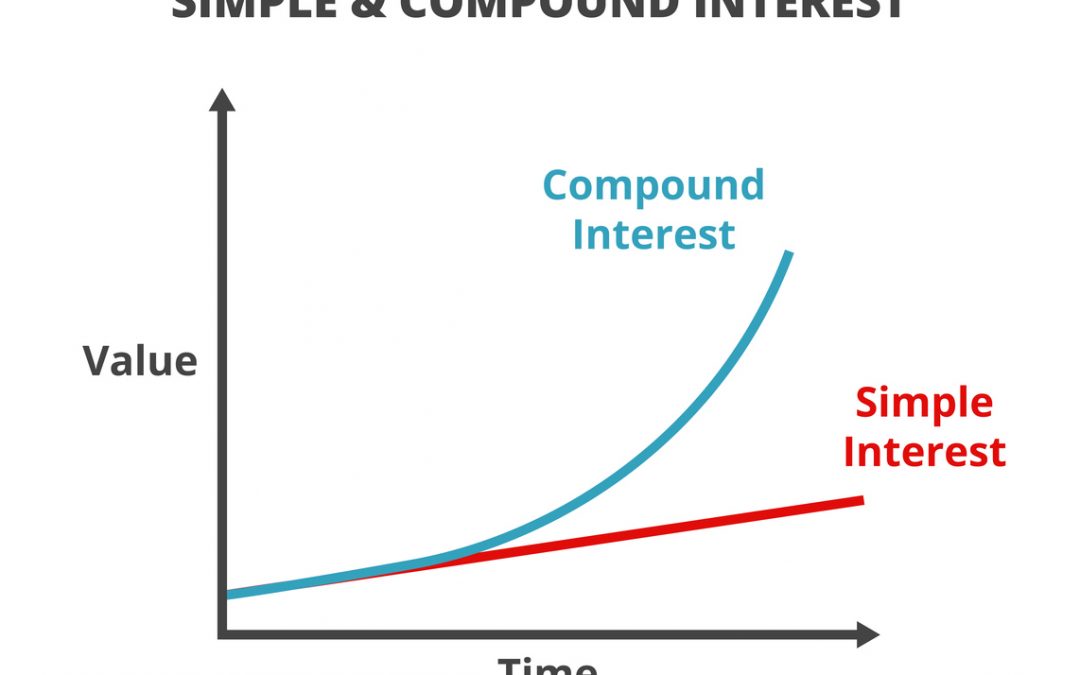

These three wise men seem to say so … There are many ways to make money. And just as many to lose it. Today’s subject is about a way to make and earn significant sums, sometimes without realising how quickly this can happen. We’re talking about compound...

by James Coyle | Dec 9, 2022 | Centrelink Age Pension, Commonwealth Seniors Health Card

What you need to know Are you one of the three-quarters of senior Australians who receives a full or part Age Pension payment? If so, it will help to know Centrelink availability, payment and reporting dates over the coming Christmas and New Year holiday period. ...

by James Coyle | Dec 2, 2022 | Centrelink Age Pension, Retirement Income

Income boosts from home equity The family home remains the single greatest source of wealth for most retirees – that fortunate 80% who live in their own dwelling. Superannuation is a more easily accessible form of wealth, but the money locked up in our homes can be...

by James Coyle | Dec 2, 2022 | Retirement Income, Retirement Spending

Retirement Pulse reports most think they are worse off financially than 12 months ago The Retirement Essentials’ November 2022 Retirement Pulse posed the question: Do you agree or disagree with this statement: ‘I feel better off financially that I did 12 months...

by James Coyle | Nov 28, 2022 | Planning for Retirement, Retirement Spending

…by projecting future income It’s great to learn that you’ve got your sums wrong, if this means that you can now retire sooner than you thought. This happened a couple of weeks back with Jenny and Kumar. They’re currently aged 68 and 69 and are keen to stop work and...